Front Page

INTRODUCTION charge and discover a lot more about what they're doing when they conserve and invest their hard-earned money. Many financiers don't understand where to turn, whom to trust, or what they must stop doing in order to attain true exceptional investment efficiency. You don't have to provide your cash to a Bernie Madoff, who'll take it but will not tell you precisely what he's doing with it.

At least, you need to learn and understand well the sound principles, tested rules and methods that can safeguard and build your financial investment portfolio gradually. Half of all Americans save and invest; now it's time to learn to do it smartly with important know-how. When I began investing, I made the majority of the very same mistakes you've probably made.

And when you buy more, you do it just after the stock has increased from your purchase rate, not after it has fallen below it. You purchase stocks when they're nearer to their highs for the year, not when they've sunk lower and look cheap. You buy higher-priced, much better quality stocks instead of the lowest-priced stocks.

Numerous don't. You pay far less attention to a company's book worth, dividends, or PE ratiowhich for the last 100 years have actually had little predictive worth in finding America's most effective companiesand focus rather on important historically tested elements such as strong profits and sales growth, rate and volume action, and whether the company is the number one earnings leader in its field with a superior new product.

All these smart actions are totally contrary to human nature! In reality, the stock market is human nature and crowd psychology on day-to-day display, plus the olden law of supply and demand at work. Since these two factors remain the very same in time, it is exceptional but real that chart patterns are simply the very same today as they were 50 years ago or 100 years back.

All of these stocks had spellbinding rate moves. Charts plus revenues will help you inform the best stocks and basic markets from the weaker, riskier stocks and markets that you need to avoid entirely. That's why I put all these impressive chart examples in Chapter 1, with notes marked on each chart to help you discover an ability that might just alter your entire life and let you live much better and far smarter.

These 100 examples are just a little sample of what you've been missing for years. We have models of more than 1,000 excellent stock exchange winners over the last 100 years. It takes just one or 2 to make your year or your future. You have to get severe and work at really discovering and understanding what you're doing when you invest.

You can definitely learn to invest wisely. This book will offer you with the investment understanding, abilities, and methods you need to become a more successful financier, if you want to operate at it. I believe the majority of people in this nation and throughout the complimentary world, whether young or old, regardless of their profession, education, background, or financial position, should learn to conserve and purchase typical stocks.

You are never too old or too young to begin investing wisely. Mike Webster is one of our in-house supervisors who also began little. In reality, Mike sold individual possessions, including his music CD collection, to raise money for investing. Prior to handling money for the firm, he had a gain of over 1,000% in his personal account in 1999, an extremely unusual year.

He benefited from the roaring bull market of the late 1990s and safeguarded most of his gains by going primarily to money in the bear market. In between 1998 and 2003, he had gotten over 1,300%. Both Mike and Steve have had their rough years, but they have actually discovered from their lots of mistakes, which we all make, and have gone on to attain considerable performance.

It did not work. Stalin's old Soviet Union killed 20 countless its own individuals. Our system of liberty and chance acts as a design of success for most countries on the planet. Today it's insufficient for you to just work and earn a salary. To do the important things you wish to do, go where you desire to go, and have the important things you wish to have in your life, you must save and invest smartly.

This book can change your whole life. No one can hold you back but yourself. Believe positive. Key elements you'll find include what the quarterly profits of these companies were at the time, what the yearly profits histories of these organizations had been in the prior three years, what quantity of trading volume existed, what degree of relative strength there was in the rates of the stocks prior to their enormous success, and the number of shares of common stock were outstanding in the capitalization of each business.

It's easy to perform this type of practical, commonsense analysis of all previous effective leaders. I have currently completed such an extensive research study. In our historic analysis, we picked the greatest winning stocks in the stock market each year (in terms of percentage increase for the year), spanning the previous 125 years.

Home Depot was among the all-time great entertainers, leaping 20-fold in less than two years from its going public in September 1981 and after that climbing another 10 times from 1988 to 1992. All of these business used interesting new entrepreneurial items and concepts. In overall, we in fact have 10 various design books that cover America's ingenious and highly effective business.

Each letter in the words CAN SLIM stands for among the 7 chief characteristics of these biggest winning stocks at their early developing phases, just prior to they made big revenues for their investors and our nation (business and staff members all pay taxes as well as assisting to improve our standard of living).

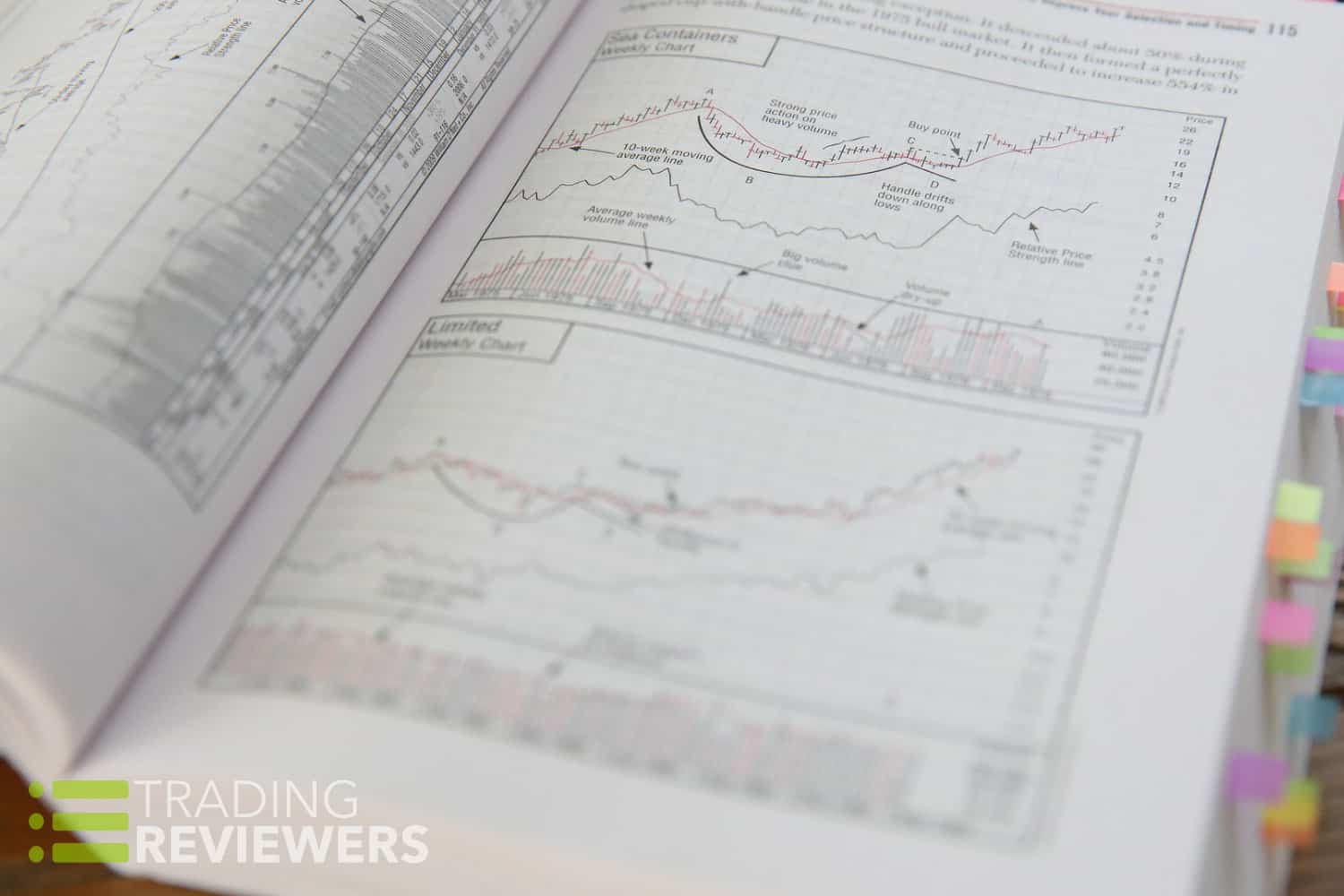

As you study these charts you'll see there specify chart patterns that are repeated over and over again whether in 1900 or 2000. This will give you a substantial advantage once you discover to, with practice, recognize these patterns that in effect tell you when a stock is under expert build-up.

The finest specialists use charts. You too can discover this important skill. This book is all about how America grows and you can too. The American dream can be yours if you have the drive and desire and make up your mind to never quit on yourself or America.

The same holds true in investing. Financial indications are plotted on graphs to assist in their analysis. A stock's price and volume history are taped on charts to help investors figure out whether the stock is strong, healthy, and under build-up or whether it's weak and behaving unusually. Would you enable a doctor to open you up and perform heart surgery if he had not utilized the vital necessary tools? Of course not.

Many investors do exactly that when they purchase and sell stocks without first consulting stock charts. Simply as physicians would be irresponsible not to utilize X-rays, feline scans, and EKGs on their patients, investors are just plain foolish if they don't discover to interpret the cost and volume patterns discovered on stock charts.

Individual investors can lose a lot of cash if they don't know how to acknowledge when a stock tops and starts into a substantial correction or if they have been depending upon somebody else who also does not understand this. Chart Reading Fundamentals A chart records the factual cost efficiency of a stock.

Investors who train themselves to decode cost movements on charts have an enormous benefit over those who either decline to discover, simply do not understand any better, or are a bit lazy. Would you fly in a plane without instruments or take a long cross-country trip in your automobile without a roadway map? Charts are your financial investment roadway map.

Chart patterns, or bases, are just areas of price correction and combination after an earlier rate advance. The majority of them (80% to 90%) are produced and formed as a result of corrections in the general market. The skill you require to learn in order to evaluate these bases is how to diagnose whether the rate and volume motions are normal or abnormal.

Failures can constantly be traced to bases that are malfunctioning or too obvious to the normal investor. Fortunes are made every year by those who put in the time to find out to analyze charts properly. Professionals who don't utilize charts are admitting their ignorance of highly valuable measurement and timing mechanisms.

When this occurs, their poor records are typically a direct result of not understanding quite about market action and chart reading. Universities that teach finance or investment courses and dismiss charts as unimportant or unimportant are demonstrating their total lack of knowledge and understanding of how the market actually works and how the best specialists operate.

(Investor's Business Daily subscribers have free access to 10,000 everyday and weekly charts on the internet at) Chart books and online chart services can help you follow hundreds and even thousands of stocks in an extremely organized, time-saving way. Some are advanced than others, providing both essential and technical information in addition to price and volume movement.

History Duplicates Itself: Learn to Use Historic Precedents As discussed in the introduction, and as revealed on the annotated charts of history's best winners in Chapter 1, our system for selecting winning stocks is based on how the marketplace actually operates, not on my or anyone else's individual opinions or academic theories.

We also found there were a variety of successful cost patterns and debt consolidation structures that duplicated themselves over and over again. In the stock exchange, history repeats itself. This is due to the fact that humanity doesn't change. Neither does the law of supply and demand. Price patterns of the fantastic stocks of the past can clearly work as models for your future choices.

I'll likewise review some signals to look out for that indicate that a price pattern may be faulty and unsound. One Of The Most Common Chart Pattern: Cup with Manage One of the most crucial rate patterns looks like a cup with a manage when the summary of the cup is viewed from the side.

The typical correction from the outright peak (the top of the cup) to the low point (the bottom of the cup) of this cost pattern differs from around the 12% to 15% variety to upwards of 33%. A strong rate pattern of any type should always have a clear and guaranteed cost uptrend prior to the beginning of its base pattern.

In many, but not all, cases, the bottom part of the cup should be rounded and give the look of a U instead of a very narrow V. This particular enables the stock time to continue through a required natural correction, with two or 3 final little weak spells around the lows of the cup.

Stocks that come directly off the bottom into brand-new highs off cups can be more dangerous because they had no pullbacks. Deep 50% to 75% cup-with-handle bases worked in 2009 since they were made by a 58% drop in the S&P 500. Sea Containers was a radiant exception. It descended about 50% during an intermediate decline in the 1975 bull market.

(See the charts for Sea Containers and The Limited.) The percent of decline is a function of the severity of the basic market decrease and the remarkable extent of the stock's previous price run-up. The formation of.

Previous Forward

Other Resources:

who to start investing in pennie stocks online | National Bestseller

how to make a profit investing in stocks and bonds | Maximizing Gains

when is a good time to start investing in stocks | Download Book Description

discuss the similarities and differences between investing in mutual funds, bonds, and stocks? | Ultimate Guide

investing in stocks in my s corporation | World

best modern method of investing in stocks | Top-Performing Strategy

***

Categories

Copyright© How To Make Money In Stocks Complete Investing System All Rights Reserved Worldwide