thinkorswim automated options trading prodigy

andrew options trading desk schwab indianapolis

hy options trading platform

schwab ira options trading

options trading pit cboe

Jeff Clark Trader Reviews: America's Boldest Financial Move? - Options Trading

The testimonials on the site were terrific, however we desired to dig a little much deeper. We looked online to find some objective testimonials, and we found Clark's track record is extremely positive. That's a remarkable accomplishment thinking about the dangerous nature of options trading. Exceptional layout and progression. The reports explain each recommendation in full detail, and signals guarantee you can time your trades with expert accuracy.

The Million-Dollar Retirement benefit report uses a proven blueprint for growing your nest egg with an incredibly easy trading routines. Clark has a sterling credibility, and online testimonials prove he is the real deal. The program features a 60-day 100% money-back guarantee so you can acquire with self-confidence. This assurance reveals that Clark really stands by his product - options trading journal.

That's more than 90% off the regular price tag of $199 annually. Options trading is perfect for people with smaller accounts and greater appetites for threat (best stocks for options trading). You can make significant returns in a short amount of time trading choices, although they tend to be riskier than more traditional assets.

Options trading is best for individuals with smaller sized accounts and greater appetites for risk due to the fact that of the volatility. However, they tend to be riskier than more standard possessions, so make sure you're ready to take chances if you wish to dance around in the choices game. If you're interested in choices trading, Jeff Clark Trader is an excellent option.

The 9-minute Rule For Jeff Clark Alliance Review - Global ... - Best Options Trading Book

Most importantly, the money-back guarantee ensures you'll leave satisfied. Otherwise, you can get a full refund, so you make certain to be pleased with your purchase. Ensure you use one of our links to access the unique 90% discount rate so you can get an even better deal. $49 for is a little price to pay for all goodies you get with this bundle, so sign up now prior to this offer is gone.

Click on this link to make the most of this promotional pricing and register for your one-year subscription for just $49 John Parker is a financing author and journalist based in the Outer Banks, NC. He operated in financing for a number of years prior to branching off into his writing profession. He is The Stock Dork's primary review writer and works with numerous other online publications.

Retirement Investments is a financial publisher that does not offer any personal financial advice or advocate the purchase or sale of any security or financial investment for any particular individual. Members must understand that financial investment markets have fundamental risks, and past efficiency does not ensure future outcomes. Retirement Investments has advertising relationships with a few of the deals noted on this site.

Retirement Investments makes every effort to keep its details precise and approximately date. The details on Retirement Investments might be different from what you find when checking out a third-party site. All items are provided without warranty. For more details, please read our full disclaimer.

Zero Stock Retirement Blueprint By Jeff Clark Trader - Options Trading

Looking for Jeff Clark Alliance Service Evaluation? I've been receiving promos for Jeff Clark's Protg Program for a while so I decided to take a more detailed look. I have actually investigated it to discover out more and assembled an honest Jeff Clark Alliance Service Review sharing all the information. weekly options trading strategy. Contents is a brand brand-new service by Jeff Clark, where you can become one of Jeff's protgs and gain access to all of his research advisory services.

For this reason, Jeff Clark began doing a weekly live-streamed Crash Course, where he gives his subscribers a real-time, over-the-shoulder view of what moves Jeff is anticipating for that day, and the techniques that he will be navigating throughout the week. best options trading book. For the remaining 7 sessions, Crash Course will just be offered for members of his elite subscription service, Jeff Clark Alliance.

SUGGESTED 5G will truly kick off on September 22. That's when Apple is expected to launch their first 5G iPhone. Details are scarce - best books on options trading. But this gives you a preview at what's within. And there's one piece that's critical to these phones. Silicon Valley's leading angel financier, Jeff Brown, believes one business behind this piece could be.

Every 3 days, typically, you'll get new trade suggestions. Around once a week, you'll get a perk trade recommendation. And every day the markets are open, you'll get real-time market training and updates. Plus, you'll also survive our feedback website, you'll have the possibility to ask and address questions, comment, share successes, and more.

Jeff Clark Options Trader Reviews - Stockmillionaires.com - Fidelity Options Trading

Around once a quarter, Jeff will hold an in-depth concern and answer session. He can't provide tailored guidance, however you'll have the possibility to ask him your most burning questions. Getting here weekly, these recommendations generally come out every Tuesday however sometimes Jeff will send them out on Wednesday or Thursday, if conditions call for.

Energy tech retail and more. They're suggested to provide you the possibility for big, short-term gains. Week after week. On the 2nd and 4th Thursday of monthly, you'll get Jeff's newest stock trading ideas. Much of these stocks are so small that you can't realistically trade options on them. binary options trading review.

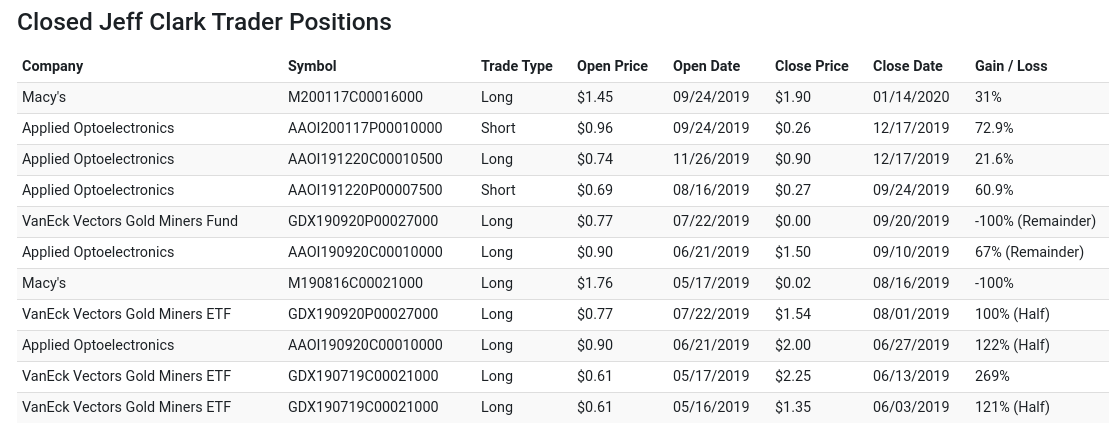

Every one is created to assist offer you the possibility to double or triple your money in the weeks and months ahead. Using his 3-stock retirement plan, Jeff will give you around 3 suggestions each month. So far, his suggestions have actually soared: 122% 269% 72% and more, in a matter of days and weeks.

Why the markets are going up why they're moving down what to anticipate next and how to benefit from it. They're all online. You can access them through your computer system or mobile phone. And you'll have unrestricted access to all of them as a protg (best options trading book). Plus, nearly when a week, you'll get a reward suggestion.

Jeff Clark Mobile - Apps On Google Play - Options Trading Platforms

We preserved the very best parts of Jeff's Mastermind course and created a classic collection of his most lucrative ideas. This collection is called: Jeff's Classic Trading Knowledge, and as a protg, it's yours complimentary. ADVISED It's not 5G, artificial intelligence, or the web of things. The answer will shock you.

Today, you can lock in a lifetime membership for simply $3,250 a special price Jeff is providing in honor of Jeff's Refresher course. Moving forward, your only additional cost will be a small annual upkeep fee of $199 to cover the expenses that originate from handling. reddit options trading. Jeff Clark is providing you 90 days to evaluate things out.

They'll offer you a full credit on your subscription cost. You can apply it to any of their other high-end research study services, or one from their corporate affiliates. To try this service.

Today's essay originates from our pal and coworker Jeff Clark, one of the best traders we know. Over the last years, he's provided 28 triple-digit winners and 78 double-digit windfalls for his readers. Below, Jeff goes over among the costliest errors he's stumbled upon in his 35 years of trading.

Jeff Clark Trader: Home - Options Trading 101

If you don't know what you're doing, it can erase your whole portfolio It took Martin just a few months to blow up his entire account. In mid-2001, Martin purchased 1,000 shares of Polaroid Corporation at $10 apiece. The company had fallen on bumpy rides (is options trading gambling). The stock had currently plunged more than 50% on the year.

"Blue-chip stocks do not simply all of an unexpected go out of business," he stated. The stock dropped to $8. And Martin bought 1,000 more shares. "It's a take at this rate," he stated. Polaroid then was up to $5 per share. "I'm not fretted about it," Martin claimed. "I have actually done the math (best binary options trading strategy).

Then when it pops back up to $7, I can sell whatever and break even." You can probably think what occurred The stock didn't appear to $7 - fx options trading. Instead, it was up to $2. Which's when Martin got aggressive. He purchased 20,000 more shares. "My average cost is now less than $3 per share.

A few days later, it traded for $1. Martin was desperate. He had "averaged down" on a bad trade. This one stock now made up the majority of his account. And it was sinking quickly. Martin started scribbling out another order ticket. options trading software reviews. The majority of the traders around Martin believed he would lastly bail out of the trade.

Jeff Clark Mobile - Apps On Google Play - Options Trading For Beginners

But that's not what Martin did. what is binary options trading. Instead, he submitted an order to purchase another 30,000 shares of Polaroid at $1. "What else can I do?" Martin described as he handed his order to the trading desk. Under his breath, another trader whispered, "You might hope the stock drops to $0.

Then you can purchase a ton and truly lower your typical expense." Less than one week later, Polaroid stopped trading at $0. 28 per share. The business stated bankruptcy (options trading 101). The stock never opened for trading once again. Martin had actually exploded his entire account. However a minimum of he only lost approximately $1.

The only time it makes good sense is when you make it a part of your technique from the beginning like if you take a smaller-than-normal position, anticipating to be at an early stage the trade. That would provide you some versatility to gradually construct the position to a typical size. That's the only time I balance down. Time works versus you. In my early years of trading, I flushed so much cash down the toilet trying to turn an earnings by balancing down on alternatives trades. It would work, maybe, 10% of the time However 90% of the time, I would quickly regret that decision. Leveraged funds fall under the very same classification.

Like with choices, time works against them. Some traders will argue that balancing down on specific stocks is various. Remember what Martin stated: "Blue-chip stocks don't just suddenly go out of organization." By averaging down, these traders state, you can lower your expense basis and make it simpler to turn a revenue on the trade.

Jeff Clark Trader Review: Is This Service A Scam Or Legit? - Binary Options Trading

Even worse, you run the opportunity of getting psychological on the trade and holding on "no matter what." That usually doesn't exercise well. Just ask Martin. Best regards and great trading, Jeff Clark For the past 6 months approximately, I've been fine-tuning what I think about the single finest concept I have actually created in three years of trading.

14% gains. I'm nearing the goal. If you want to get updates on this project, along with my early morning market commentary, the Market Minute, click here and you'll instantly be added to my list - explain options trading.

Called a popular Japanese fashion brand with numerous branches in numerous various nations, UNIQLO is a brand specializing in manufacturing distinct products with luxurious fabrics with innovative techno Gadgetlootbox Gadgetlootbox is among the flourishing Chinese retailers around the globe offering discounts on selected items. It offers enormous discounts and vouchers on the majority of the products tha Today, programming has ended up being the most importantlanguage that one should discover.

It will influence the world and change the method people communicate or influence oth While our contemporary world has actually offered us with a great deal of concerns and obligations, we have lost time for ourselves - options trading recommendations. We are too busy to find the things that we enjoy and delight in. In the middle of all this Mulling over all variables, when your company is as yet youthful and producing, you won't have adequate income to deal with its turn of events, so it can understand its biggest development limit.

***

Categories

Copyright© jeff clark trader All Rights Reserved Worldwide