Front Page

Porter Stansberry Advice

He explains why in the essay listed below. We need to speak about true monetary madness. It's something you do not see very typically. It can result in the most incredible gains of your investing life. porter stansberry predictions 2015. Or it can damage all of your wealth if you're swept up in it. I've just seen two authentic investment manias.

I'm speaking about genuine "one way" tradessituations that can only result in disaster - porter stansberry america 2020. Yet for some reason, everybody pertains to see the trade as a sure method to earn money, not lose it. *** Let me present the idea with a real story. It's about John Templeton. You might have become aware of him before.

He developed a big mutual-fund business, Templeton Investments, which he offered in 1992 and made $440 million - porter stansberry debt jubilee. His first "big trade" came right after Hitler got into Poland in 1939. Stocks sold, hard. There were 104 different stocks on the New York Stock Exchange that were trading for $1 or less (porter stansberry newsletter).

His rationale was that during the Depression there was a surplus of everything, and for that reason no revenues. Throughout a war, which was surely coming, there would be a lack of everything and huge profits - porter stansberry america 2020. Within three years he 'd made a revenue on all but 4 of the stocks. Over a years, the profits on this trade were more than 10,000%. snopes porter stansberry.

Innovation stocks had been on a tear higher considering that the mid-1990s, with business like Intel, Microsoft, Yahoo, and Qualcomm earning huge returns for financiers. Later, though, the number and quality of the companies reaching the general public markets began to decline significantly. porter stansberry america 2020. And by January of 2000, the scenario reached a peak.

Therefore, en masse, investors began to think a lie that couldn't perhaps be real. porter stansberry predictions. It was the best financial mania the world had actually seen because John Law's South Sea Bubble in the early 1700s. *** I enjoy to report that we did a good job cautioning individuals about what was actually taking place As Steve Sjuggerud wrote in January 2000 (on the newsletter's front page): We are at the peak of many likely the biggest monetary mania that will ever be seen in our life times and quite potentially the best ever experienced (porter stansberry american 2020).

If you remained in the markets at that time, you undoubtedly remember a few of the most well-known disastersPets.com, Webvan, and WorldCom. These companies were backed by respected endeavor capitalists and had organisation plans that were at least possible. But this wasn't just a bubble. It was a mania - porter stansberry and ron paul. Even the most clearly worthless endeavors reached multibillion-dollar assessments.

It made generic software for web service providers, but never ever earned a profit. In 2002, Yahoo acquired the company for $235 million. It paid too much - porter stansberry america 2020. In 2009, the Inktomi software application was contributed to the general public under an open-source license. Everybody can utilize it today for totally free. Boo.com spent $188 million of financiers' cash and deserved more than $1 billion (on paper) (snopes porter stansberry).

Pixelon was a digital-streaming business that released operations with a $16 million celebration, featuring The Who and the Dixie Chicks. It stopped working in less than a year. It never ever produced any earnings. And Lycos was a fourth-rate online search engine. Spanish telecom operator Telefonica bought it for $12.5 billion. In 2004, it sold it for $95 million.

Its owners promise that "brand-new Lycos" is coming quickly (porter stansberry america 2020). It's traded in India, if you're interested. There were numerous IPOs like these. An index of dot-com companies tracked by TheStreet.com fell 75% in 2000. Many stocks fell by 99%consisting of U.S. Interactive, Pacific Gateway Exchange, Cornerstone Web Solutions, and Worldwide Exceed Group.

Porter Stansberry Bio

Most of the disclosures stated clearly that these business had few, if any, clients. Most of them stated they had no written agreements or agreements. The risk disclosures described, in plain English, that these weren't real businesses and they had near to zero possibility of remaining in service. And it didn't matter.

It was a true mania (porter stansberry america 2020). *** Templeton viewed the market action silently from his retirement community in the Bahamas. Finally, on January 1, he understood that the mania could not go on a lot longer. The frauds were surpassing the legitimate IPOs by 10-to-1. He called his broker in New York and provided very easy instructions: Short as many shares as you can get of every technology IPO that notes.

(The lock-up avoids insiders from offering shares until some period after the IPO, usually 90 days.) In the very first half of 2000, Templeton ended up shorting 84 stocks, putting an average of $2.2 million into each of them. porter stansberry america 2020. He made more than $100 million on the trade, in about a year (porter stansberry 2020).

Of the trade, Templeton informed Forbes publication: This is the only time in my 88 years when I saw technology stocks go to 100 times incomes; or, when there were no incomes, 20 times sales - porter stansberry 2012. It was crazy, and I made the most of the short-term madness (porter stansberry american 2020). I never ever thought I 'd see a mania like that happen again in my life.

This was a circumstance where financiers were totally neglecting the apparent reality that the frustrating majority of these business would stop working and after that bidding them approximately totally crazy prices. This wasn't overexuberance. It was insanity. And over the next 24 months, financiers saw $5 trillion of market price disappear (who is porter stansberry). porter stansberry research.

It's a mania that has actually been created (and is being sustained) by central banks and printing presses. Today, worldwide, something around $15 trillion in fixed earnings is trading at a cost that guarantees financiers will lose cash if they buy the bond and hold it till maturity. I wish to ensure you understand what's happening since the bond market and bonds are a mystery to a great deal of specific investors.

How can that take place? It takes place when financiers bid the existing cost of a bond up until now above par that the remaining coupons to be paid will not cover the loss when the bond develops. So for example, you may see a bond trading at $130, when it only has $29 worth of interest delegated be paid prior to it grows at $100.

Is the Stansberry Report worth it?

Where is Porter Stansberry?

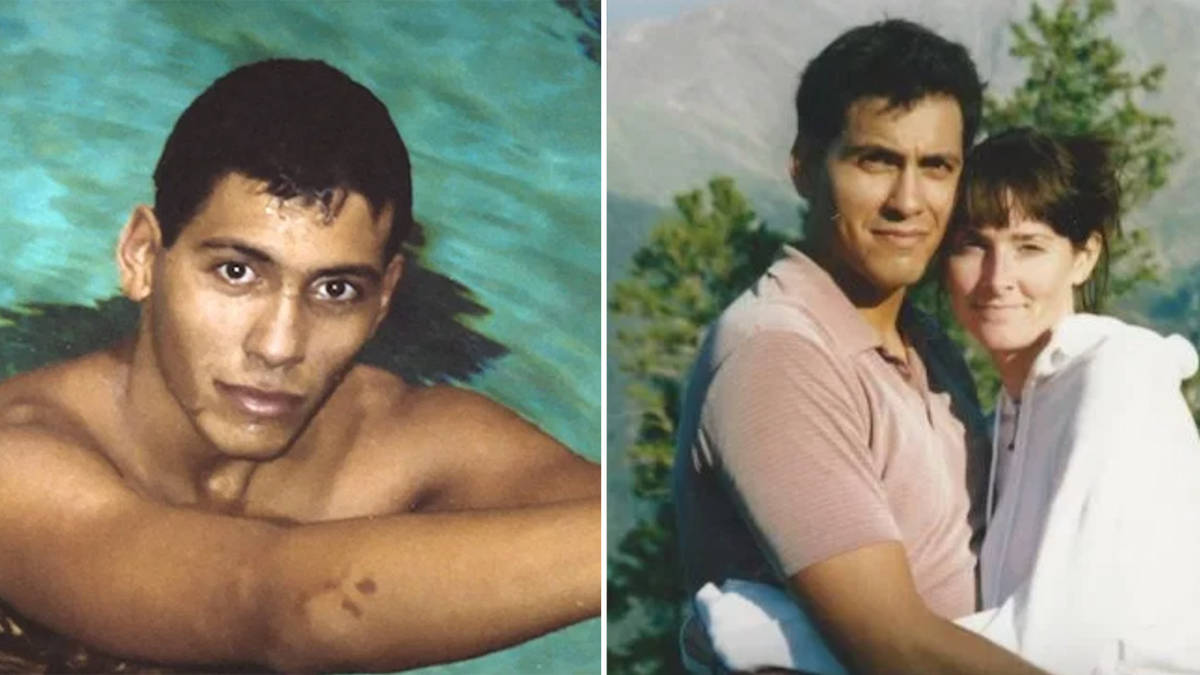

What really happened to Rey Rivera?

WHO IS DR sjuggerud?

How do I cancel Stansberry Research?

How do I invest in stocks?

- Open a brokerage account. If you have a basic understanding of investing, you can open an online brokerage account and buy stocks. ...

- Hire a financial advisor. ...

- Choose a robo-advisor. ...

- Use a direct stock purchase plan.

How do you invest in Blockchain?

Who is Stansberry Investment Advisory?

Stansberry Research is a publishing company and investment advisory service that was founded in 1999 by Frank Porter Stansberry. ... Since then, the company has expanded and now offers a range of investment advisory services related to retirement, commodities, and stocks.Apr 5, 2020

What happened to the unsolved mysteries guy?

Why did Rey Rivera die?

Who killed Patrice Endres?

What is historically the worst month for stocks?

What is a meltup?

What is the best stock to invest in today?

| Best Value Stocks | ||

|---|---|---|

| Price ($) | Market Cap ($B) | |

| NRG Energy Inc. (NRG) | 33.74 | 8.2 |

| Vornado Realty Trust (VNO) | 36.21 | 6.9 |

| MGM Resorts International (MGM) | 15.41 | 7.6 |

What are the best stocks to buy for beginners?

Is now a good time to invest in the stock market?

Who is the owner of Blockchain?

Who is the biggest Blockchain company?

What is the best Blockchain stock to buy?

- Intel Corp. (INTC)

- Canaan (CAN)

- Galaxy Digital Holdings (GLXY. V)

- Silvergate Capital Corp. (SI)

- Square (SQ)

- Intercontinental Exchange (ICE)

Who owns Agora?

| Type | Publishing company |

|---|---|

| Founder | Bill Bonner |

| Headquarters | Baltimore, MD |

| Parent | The Agora |

| Website | agorafinancial.com/ |

Of course, all financiers believe that they will be nimble sufficient to offer before that happens. And all financiers believe that the governments will continue to purchase these bonds or perhaps even stocks and do whatever it requires to keep the bubble growing. This situation is the meaning of an investment mania.

Last Article Forward

See Also...

porter stansberry big trade - Porter Stansberry

porter stansberry new book - Porter Stansberry

porter stansberry america 2020 the survival blueprint - Porter Stansberry

***

Categories

Copyright© Porter Stansberry All Rights Reserved Worldwide