teeka tiwari glenn beck

glenn beck teeka tiwari

teeka tiwari twitter

teeka tiwari 2020 pick

megatrends teeka tiwari

teeka tiwari crypto master course

is teeka tiwari an expert in identifying the best crypto currencies?

teeka tiwari loki

teeka tiwari penny cryptos

teeka tiwari-scam

teeka tiwari, the big black book

teeka tiwari o

teeka tiwari - palm beach confidential torrent

singulardtv teeka tiwari

teeka tiwari pdf

teeka tiwari palm beach letter

cryptocurrency conspiracy of 2018 by teeka tiwari and glenn beck

daily show with jon stewart teeka tiwari

the etf master trader with teeka tiwari

mike dillard and teeka tiwari

glenn beck teeka tiwari bitcoin master course

teeka tiwari scammer?

teeka tiwari and glenn beck

teeka tiwari course review

teeka tiwari announcement

what cryptocurrency was created by an internet company recomended by teeka tiwari

whete teeka tiwari was born

teeka tiwari gr

we're following this "boy genius" into the bank of the future by teeka tiwari

wikipedia teeka tiwari

teeka tiwari steem

teeka tiwari meme

teeka tiwari,

http://reviewupviral.com/great-cryptocurrency-conspiracy-2018-teeka-tiwari/

teeka tiwari litecoin

shearson lehman teeka tiwari

what teeka tiwari is saying about bitcoin and the stock market?

teeka tiwari bitcoin crypto master course the blaze

how much does teeka tiwari charge

teeka tiwari and the big black book of secret income

stock gumshoe teeka tiwari next bitcoin

5 coins to 5 millions review teeka tiwari

teeka tiwari top 5 coins revealed forum

has teeka tiwari ever really been on jon stewart

anybody leaked teeka tiwari 3-15-18

teeka tiwari live forum

teeka tiwari training

teeka tiwari editor, palm beach confidential

teeka tiwari palm beach telegram

teeka's crypto picks teeka tiwari review

teeka tiwari hedge fund

teeka tiwari transparency

teeka tiwari cbd 50 cent dstock which company? private placement motely fool

is teeka tiwari a scam

teeka tiwari "born

charlie shrem teeka tiwari

teeka tiwari question and answers

palm beach � confidential teeka tiwari and bitcoin filetype:pdf

teeka tiwari pbo

anybody leaked teeka tiwari

teeka tiwari course

teeka tiwari video marketing scam?

facebook teeka tiwari

teeka tiwari top 5 coins revealed forum 2019

what did teeka tiwari suggest

teeka tiwari palm beach confidential filetype:rar

teeka tiwari 2018 prediction

where to be invested now teeka tiwari

teeka tiwari palm beach confidential

teeka tiwari net weoth

master course in crypto currency teeka tiwari

teeka tiwari cannabis companies

is teeka tiwari fraud

teeka tiwari rating

teeka tiwari bbb

how much does teeka tiwari cost

teeka tiwari � palm beach confidential

teeka tiwari +forbes

palm beach teeka tiwari crypto picks

teeka tiwari banned from stocks

teeka tiwari king

beck, teeka tiwari,

top coins recommended by teeka tiwari

teeka tiwari on market manipulation

teeka tiwari montly crypto

teeka tiwari bitcoin 2019

teeka tiwari legal problems

stock gumshoe teeka tiwari pocket change summit

teeka tiwari new deal money

teeka tiwari ripoff report

teeka tiwari net worth?

teeka tiwari + mailing address

cryptocurrency guru teeka tiwari

teeka tiwari bitcoin scam

teeka tiwari leak

teeka tiwari one-page guide to cryptocurrency

teeka tiwari on why the smart money is missing out on crypto

teeka tiwari palm beach confidential intitle:index.of

teeka tiwari, 4 �penny crypto� targets

|

Ryan: So you have actually looked at business that are huge business, you have actually assessed much bigger marketcap type circumstances. Do you feel that that experience has helped you? Or are we in such, type of the infancy, that as you mentioned, it is almost just good sense. You just have to kind of appearance at it and believe rationally about what's going on, and pull the emotion out? You need to pull the emotion out, and there are no conventional metrics that you can look at.

Okay. What I can use that I gained from working on Wall Street throughout three years, is how to check out people - So I think that's most likely one of my super powers, if you will. And if you have actually got a great BS detector, you should listen to it. Okay. You ought to absolutely listen to it. If I'm taking a seat and I'm talking with somebody, and they've got all the bonifides, but you understand, there's just; it's not agreeing with me, there's something about them that's not sitting well with me.

There are many other offers out there to look at. Yeah, there's excessive chance. Yeah. And speaking of opportunity, you understand, you type of mentioned at the beginning, Bitcoin and Ethereum, the majority of people have heard of these two, especially Bitcoin, because it looks like it's in the news all the time, something or the other.

Have they failed on Bitcoin? Bitcoin is trading practically upwards of $6,000 recently; it's turned up from say $3,000 not too long earlier, it's quite volatile. Do they sort of wait on a pullback, or do they simply state, "Okay, I'm going to buy some Ethereum, I'm going to purchase some Bitcoin, see you in 10 years." You know? Yeah that's a terrific concern.

You can actually utilize small stakes, and transform them into life-altering quantities of cash. So I believe the initial step is, get clear on, if I lost all this cash tomorrow, if I put it in Bitcoin, I desire to make certain that it's not going to have me asking my parents for hamburger cash, and sleeping on their sofa.

And then on the very first 50% pullback that you see in Bitcoin, purchase the second half. And that way you're not going to get the perfect cost, however you're going to get a good rate. And then just leave it alone. And to your concern, is it too late to buy Bitcoin? Absolutely not.

Right now it has about simply under a $100 billion market cap, so it's a 10x from here. undefined. So you put $1,000 in, you turn it into $10,000. I mean, I'll take that all day long. A bit much easier in cryptocurrency than getting Apple stock. Right! And you talked about this volatility.

Suggesting that Bitcoin is about 10 times more unstable. And they believe that as it becomes less and less unstable, it's going to be simpler to in fact depend on as a currency. Correct. Now, we remain in an age where news, whether you call it FUD, fear, unpredictability, doubt, truly drives the prices of these cryptocurrencies up and down it seems like.

Even more, to a level, than the stock exchange. Due to the fact that there are bigger gains and bigger drops. Do you feel that the marketcap needs to go up to help control that volatility? So that there's, it's expanded wider? Do you feel that the news has to turn positive? What do you feel is going to help reduce that volatility, which in turn will result in more widely accepted usage of an actual currency? It's kind of like the chicken egg thing practically, however there's got to be some point where it transitions ( And it shows that you really do comprehend the area asking that question. So generally the life process of new ideas is that it's the speculators and the early adopters that initially come into it, before it enters into mass adoption, and after that becomes what we would think about real innovation, right? Right.

It went from pennies to a hundred and modification, and then back to like, 5 dollars, and now it's overcome a half a trillion market cap. Yeah. So what you'll see is a similar scenario with Bitcoin. Now we also saw Bitcoin go from cents to $1,200, pull back to $200.

It's now in its phrase of going into its mainstream stage. Now, in order for it to be a currency, you're right, the volatility has to reduce greatly. And it can't reduce significantly till it gets actually above a trillion market cap. Okay. So the question is, what takes it to a trillion market cap if it can't be utilized as a currency? And it will be speculation that gets it there.

Therefore, as institutional money starts entering into the market, which is what I anticipate will happen in 2018, and I'll tell you why I believe that in a moment, that speculation will be self-reinforcing, and it will take Bitcoin to the point where volatility will come way, method, way down, and all of an abrupt, it's now something you can use legitimately to pay incomes and buy things and really utilize as a currency - It's more of a speculative car that is also a warehouse of value. Mm-hmm (affirmative). Therefore when you take a look at, you sort of talked about position sizing and going into in and searching for, I think you discussed a 50% pullback ( In cryptocurrency, I keep in mind not too long ago, Ethereum, I seem like it went from $300 to ten cents or something in a day. That's right. However then, next thing you know, it was back towards $400, and then it's pulled back. So the volatility ranges are rather different. Do you kind of think that, 'cause what I'm attempting to get at here is, there are individuals who try and time the marketplace.

And what I'm trying to determine is, are you more simply put something in, if there's a pullback, put some more in. Yep. If it pulls back even further, look at your position sizes. If it makes sense, perhaps purchase once again. However don't get too captured up in the plus green balance in your account, or the minus red balance, you know? Since- Yep, 100%.

Yep, 100. That is the way to go, since we could have one announcement tomorrow, and Bitcoin's $25,000, and then you would have missed it, right? Mm-hmm (affirmative). So get in, get your feet damp. Begin with something that's not going to squash you if you're down 50 or 60% - Don't go put $200,000 in, and you're down 60% tomorrow, and you're ready to leap off a building. Do not do that, that's just not smart. Be reasonable, get your feet wet with this innovation. Know that you're not going to get a perfect print, right? Put your ego aside, toss it out the room, it's got no organization here.

You will see a 50% pullback in Bitcoin at some time. Now we might go to $15,000 first, before that next 50% pullback. But you will see one. So put your half position on, wait on the very first 50% pullback, put your other position on, and strap in for the flight, 'cause it's going to be remarkable.

Yeah. Which leads me to feeling. I trade choices myself, too, and for me, stock trading and particularly option trading, fits my character profile. I'm extremely unemotional; I'm disciplined, I search for the finest, and after that enter the better. I'm really tactical about it. However the typical individual as we understand, is reactive, when it comes to investing, they desire to buy Amazon when it's now trading over $1,000, and they want to sell it when it's at $800, and purchase it back when it's at $1,200.

And I look at the same challenge with cryptocurrency, except I see it on a more extreme level, because it has an even larger FOMO mentality. Where people have this worry of missing out on out, they believe, I could have bought Bitcoin at pennies, and if I would have bought $100, I 'd have $70 million or whatever, you see these short articles all the time.

That was most likely not very great." And I had actually done that several times in these much lower numbers. However at that time these were revenues, right? These were real earnings. And who knew that it 'd be $5,000, $6,000, $20,000, whatever. So there is even some of this internal FOMO of like, what's the next one? Oh, I've got to discover it.

And outside of position sizing, how do you encourage the folks that you educate about cryptocurrencies to protect themselves from this FOMO, psychological spiral that can take place? Yeah, so once again, a lot of the time, every other week I put out a video, and I yap about rationality, being rational.

On our journey to producing wealth, it's not the government or somebody else or our moms and dads who are holding us back, right? It's all up in here. Since money does not care what color you are, it doesn't matter what school you went to; it doesn't care if you check out well, or if you are great looking, or if you are awful.

So we bring all of our own drama to a production of wealth. So a few of the things that I do to help us safeguard ourselves from that is diversity, to be modest sufficient to state, "Look, I might suggest an idea that could go to zero." And so we require to be diversified, and the other thing that we do is we use something called consistent position sizing.

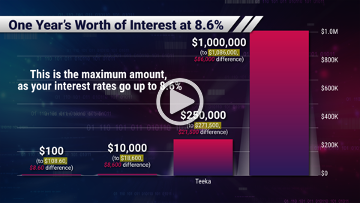

So I'll provide you a prime example. I suggested an extremely, really little cryptocurrency earlier this year at 13 cents. And I stated, "Look, if you're a little player, probably put $200 to $400, perhaps $500 max in it. And if you're a bigger gamer, you can put $1000 into it." And so that specific coin went to as high as $50.

Yeah, yeah. Right? So, I'm not going to say that every single idea I take a look at does that. There are some concepts that have not worked out. However when you have a portfolio of concepts, and you utilize consistent position sizing, a few things take place. One, you're going to get lucky, best? You're going to have a couple of trades that are just fantastic.

Even if you have ten concepts with $500 each in, $5,000, for many people, they lose $5,000, if everything went to absolutely no, yeah, it's gon na suck. It's not pleasant. But it's not going to put you in the poorhouse, right? You're not going to be sitting outside of Grand Central Station with your hat in your hand begging for burger cash.

Because of the beauty here Ryan, you understand I get passionate about this, you've got to forgive me, however the beauty here is we're so early. Mm-hmm (affirmative). We're so early, that we do not need to be that intense, ideal? We need to be brilliant enough to have a core portfolio of great names, to have rational position sizing, and after that be bright sufficient to do nothing however wait.