teeka tiwari

teeka tiwari picks

teeka tiwari wikipedia

teeka tiwari palm beach

teeka tiwari bio

who is teeka tiwari

teeka tiwari youtube

teeka tiwari 2020 stock pick

teeka tiwari nationality

does wall street know teeka tiwari

teeka tiwari particl coin

teeka tiwari stream

teeka tiwari black book

d1-z teeka tiwari

what brokerage does teeka tiwari use

teeka tiwari enigma eng

glenn beck teeka tiwari youtube

teeka tiwari announcement august 20

ext:pdf palm beach teeka tiwari

crypto expert teeka tiwari

teeka tiwari 5 coins to 5 million

teeka tiwari editor, palm beach research group

palm beach reserch group teeka tiwari news letter june 2018

teeka tiwari cyrpto

teeka tiwari editor, palm beach confidential review feedback

pbo teeka tiwari

teeka tiwari cbd private placement motely fool

stock gumshoe investors alley teeka tiwari

teeka tiwari re

teeka tiwari is he a slick willy

teeka tiwari legal pot run

teeka tiwari crypto

teeka tiwari top ten

teeka tiwari cannabis recommendations

teeka tiwari florida address

palm beach confidential quarterly income by teeka tiwari)

teeka tiwari barred finra

teeka tiwari 5 coins review

what are the 5 coins teeka tiwari talks about?

teeka tiwari newsletter download

glenn beck teeka tiwari cryptocurrency

unclaimed money handbook teeka tiwari

aion teeka tiwari

palm beach confidential (cryptocurrency) - teeka tiwari (update 06.2018) dlfree 24h

mining teeka tiwari crypto

teeka tiwari chainlink

training videos from teeka tiwari

teeka tiwari cbd 50 cent dstock which company?

palm beach � confidential teeka tiwari and bitcoin filetpye:pdf

teeka tiwari crypto projections

teeka tiwari cryptocurrency master course review

palm beach � confidential teeka tiwari and bitcoin pdf

cyrptoshow.com teeka tiwari

teeka tiwari e-mail

stock gumshoe teeka tiwari

teeka tiwari article

teeka tiwari cryptocurrency class

whats teeka tiwari cryptocurrency play stock gumshow

teeka tiwari report

teeka tiwari icon

teeka tiwari and the big black book of secrets

teeka tiwari dirt

glenn beck & teeka tiwari

teeka tiwari enigma

teeka tiwari top cryptocurrency picks

teeka tiwari uses bittix

teeka tiwari date pf birth

"teeka tiwari"

teeka tiwari pick march 14, 2018

palm beach letter teeka tiwari big black book

track record of teeka tiwari

teeka tiwari 2020

teeka tiwari list of coin picks

new world money teeka tiwari

teeka tiwari neo

teeka tiwari parents born

teeka tiwari recent conferences attended

teeka tiwari alerts

teeka tiwari 5 coins 2020

blockchain+teeka tiwari

teeka tiwari bits buy system

teeka tiwari chief investment analyst the palm beach letter

teeka tiwari omg

teeka tiwari ico

glenn beck teeka tiwari cryptocurrency review

teeka tiwari crypto academy training site

"teeka tiwari vechain"

teeka tiwari kingmaker

teeka tiwari bitcoin training video

teeka tiwari question and answer

teeka tiwari april

teeka tiwari master course

teeka tiwari ncome exodus

http://constantprofitsclubz.com/palm-beach-confidential-review-teeka-tiwari-newsletter/

crypto predictions 2018 teeka tiwari

teeka tiwari competitors

teeka tiwari wikipedia lost trading license

what is the new crypto currency teeka tiwari will buy?

5 coins that teeka tiwari recommends

teeka tiwari top coins

teeka tiwari july 20, 2018 recommendation

teeka tiwari cryptocurrency

ask me anything teeka tiwari webinar website

teeka tiwari free crypto course

teeka tiwari predictions

teeka tiwari kingmaker pick

can i cancel teeka tiwari

palm beach confidential" by teeka tiwari

what new crypto currency did teeka tiwari recommend?

teeka tiwari today's pick

teeka tiwari 5 coins to invest in

palm beach research group teeka tiwari newsletter june 2018

teeka tiwari glenn beck bitcoin

|

Ryan: So you've looked at business that are big companies, you've assessed much bigger marketcap type situations. Do you feel that that experience has assisted you? Or are we in such, type of the infancy, that as you discussed, it is practically just sound judgment. You just have to type of take a look at it and believe logically about what's going on, and pull the emotion out? You have to pull the feeling out, and there are no traditional metrics that you can look at.

Okay. What I can use that I gained from working on Wall Street across three decades, is how to check out individuals - So I think that's probably among my super powers, if you will. And if you have actually got a good BS detector, you need to listen to it. Okay. You ought to definitely listen to it. If I'm sitting down and I'm talking with somebody, and they've got all the bonifides, but you understand, there's simply; it's not sitting well with me, there's something about them that's not agreeing with me.

There are many other deals out there to look at. Yeah, there's too much chance. Yeah. And speaking of opportunity, you know, you sort of pointed out at the beginning, Bitcoin and Ethereum, the majority of individuals have heard of these 2, particularly Bitcoin, because it looks like it remains in the news all the time, something or the other.

Have they failed on Bitcoin? Bitcoin is trading nearly upwards of $6,000 just recently; it's shown up from state $3,000 not too long earlier, it's quite volatile. Do they kind of wait on a pullback, or do they simply say, "Okay, I'm going to buy some Ethereum, I'm going to purchase some Bitcoin, see you in 10 years." You know? Yeah that's a fantastic concern.

You can literally utilize tiny stakes, and change them into life-changing quantities of cash. So I think the initial step is, get clear on, if I lost all this cash tomorrow, if I put it in Bitcoin, I desire to make sure that it's not going to have me pleading my moms and dads for hamburger cash, and sleeping on their couch.

And after that on the first 50% pullback that you see in Bitcoin, purchase the 2nd half. Which method you're not going to get the perfect rate, however you're going to get a great rate. And after that simply leave it alone. And to your concern, is it too late to buy Bitcoin? Definitely not.

Today it has about simply under a $100 billion market cap, so it's a 10x from here. Meaning that Bitcoin has to do with 10 times more volatile. And they believe that as it ends up being less and less unstable, it's going to be simpler to really rely on as a currency. Correct. Now, we remain in an age where news, whether you call it FUD, fear, unpredictability, doubt, really drives the costs of these cryptocurrencies up and down it seems like.

Much more, to a degree, than the stock market. Due to the fact that there are larger gains and larger drops. Do you feel that the marketcap has to go as much as help control that volatility? So that there's, it's expanded broader? Do you feel that the news needs to turn favorable? What do you feel is going to assist decrease that volatility, which in turn will lead to more widely accepted use of an actual currency? It's type of like the chicken egg thing almost, but there's got to be some point where it transitions (undefined).

And it reveals that you truly do understand the area asking that question. So normally the life cycle of brand-new concepts is that it's the speculators and the early adopters that first enter it, prior to it goes into mass adoption, and then becomes what we would think about real innovation, right? Right.

It went from pennies to a hundred and change, and then back to like, 5 dollars, and now it's overcome a half a trillion market cap. Yeah. So what you'll see is a comparable situation with Bitcoin. Now we likewise saw Bitcoin go from pennies to $1,200, back down to $200.

It's now in its phrase of going into its mainstream phase. Now, in order for it to be a currency, you're right, the volatility needs to diminish considerably. And it can't lessen greatly till it gets truly above a trillion market cap. Okay. So the question is, what takes it to a trillion market cap if it can't be utilized as a currency? And it will be speculation that gets it there.

And so, as institutional cash begins entering the marketplace, which is what I prepare for will happen in 2018, and I'll inform you why I believe that in a minute, that speculation will be self-reinforcing, and it will take Bitcoin to the point where volatility will come method, way, way down, and all of a sudden, it's now something you can utilize legally to pay incomes and purchase things and really utilize as a currency - It's more of a speculative car that is also a warehouse of worth. Mm-hmm (affirmative). And so when you take a look at, you sort of spoken about position sizing and going into in and searching for, I think you discussed a 50% pullback (undefined). You understand, typical stock financiers might take a look at, okay if a stock pulls back, or the market pulls back 10%, it's a correction.

In cryptocurrency, I remember not too long earlier, Ethereum, I feel like it went from $300 to 10 cents or something in a day. That's right. However then, next thing you know, it was back towards $400, and after that it's drawn back. So the volatility varieties are quite different. Do you sort of think that, 'cause what I'm attempting to get at here is, there are individuals who try and time the marketplace.

And what I'm trying to determine is, are you more just put something in, if there's a pullback, put some more in. Yep. If it pulls back even further, take a look at your position sizes. If it makes sense, possibly buy once again. But don't get too captured up in the plus green balance in your account, or the minus red balance, you understand? Because- Yep, 100%.

Yep, 100. That is the way to go, because we could have one announcement tomorrow, and Bitcoin's $25,000, and then you would have missed it, right? Mm-hmm (affirmative). So get in, get your feet damp. Begin with something that's not going to squash you if you're down 50 or 60% - Do not go put $200,000 in, and you're down 60% tomorrow, and you're ready to jump off a structure. Do not do that, that's just not smart. Be rational, get your feet wet with this innovation. Know that you're not going to get a perfect print, right? Put your ego aside, toss it out the room, it's got no business here.

You will see a 50% pullback in Bitcoin at some time. Now we might go to $15,000 initially, prior to that next 50% pullback. However you will see one. So put your half position on, await the first 50% pullback, put your other position on, and strap in for the flight, 'cause it's going to be amazing.

Yeah. And that leads me to feeling. I trade options myself, too, and for me, stock trading and particularly alternative trading, fits my personality profile. I'm really unemotional; I'm disciplined, I search for the best, and then get in the much better. I'm really strategic about it. However the typical individual as we understand, is reactive, when it concerns investing, they wish to buy Amazon when it's now trading over $1,000, and they wish to sell it when it's at $800, and buy it back when it's at $1,200.

And I take a look at the exact same difficulty with cryptocurrency, except I see it on a more extreme level, since it has an even bigger FOMO mindset. Where individuals have this fear of missing out, they believe, I might have bought Bitcoin at pennies, and if I would have purchased $100, I 'd have $70 million or whatever, you see these short articles all the time.

That was most likely not excellent." And I had actually done that several times in these much lower numbers. But back then these were earnings, right? These were real revenues. And who knew that it 'd be $5,000, $6,000, $20,000, whatever. So there is even a few of this internal FOMO of like, what's the next one? Oh, I have actually got to discover it.

And beyond position sizing, how do you recommend the folks that you inform about cryptocurrencies to secure themselves from this FOMO, psychological spiral that can occur? Yeah, so once again, a lot of the time, every other week I put out a video, and I talk a lot about rationality, being rational.

On our journey to producing wealth, it's not the government or somebody else or our parents who are holding us back, right? It's all up in here. Because cash does not care what color you are, it does not matter what school you went to; it doesn't care if you check out well, or if you are great looking, or if you are unsightly.

So we bring all of our own drama to a creation of wealth. So some of the things that I do to assist us secure ourselves from that is diversification, to be humble enough to say, "Look, I might suggest an idea that might go to absolutely no." Therefore we require to be diversified, and the other thing that we do is we utilize something called consistent position sizing.

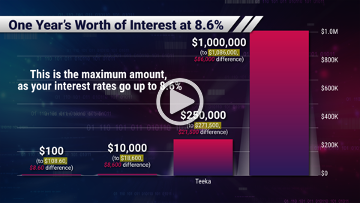

So I'll give you a prime example. I advised a very, really little cryptocurrency previously this year at 13 cents. And I stated, "Look, if you're a little player, probably put $200 to $400, perhaps $500 max in it. And if you're a larger gamer, you can put $1000 into it." And so that particular coin went to as high as $50.

Yeah, yeah. Right? So, I'm not going to state that every single idea I take a look at does that. There are some concepts that haven't exercised. But when you have a portfolio of ideas, and you use uniform position sizing, a few things occur. One, you're going to get lucky, right? You're going to have a couple of trades that are simply incredible.

Even if you have ten ideas with $500 each in, $5,000, for the majority of people, they lose $5,000, if whatever went to absolutely no, yeah, it's gon na suck. It's not enjoyable. But it's not going to put you in the poorhouse, right? You're not going to be sitting beyond Grand Central Station with your hat in your hand begging for burger money.

Since of the charm here Ryan, you know I get enthusiastic about this, you have actually got to forgive me, but the appeal here is we're so early. Mm-hmm (affirmative). We're so early, that we don't need to be that intense, ideal? We need to be bright sufficient to have a core portfolio of terrific names, to have rational position sizing, and after that be intense enough to do absolutely nothing however wait.